CCR Re maintained its record of profitable growth, reporting an increase in premium income (up 21%), an improvement in the Non-Life combined ratio (98.1%) and stable net income(€35 million).

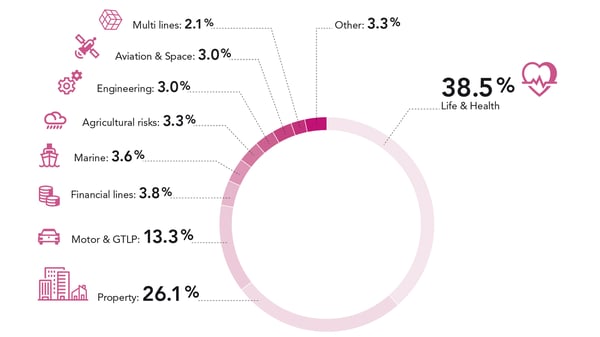

Gross written premium totaled €562 million, up 21% compared with 2018 (including 18% growth at constant exchange rates). The business mix was as follows:

Gross Written Premiums +21%

(Millions of €)

Portfolio profitability continued to strengthen during the year. Non-Life combined ratio improved significantly, falling to 98.1% despite significant Nat Cat loss ratio, as was the case in 2018, especially in Japan. Life reinsurance margin was amounted to 5.2%.

Non-life combined ratio

The overall return on investment reached 2.7%. The portfolio market value amounted to €2.5 billion at December 31, 2019, up by some €190 million (+8%) compared with the previous year-end.

CCR Re cost ratio improved to 5.5% in 2019.

Current income before equalization reserve amounted to €56 million, up 23% on 2018.

Current income +23%

(Millions of €)

CCR Re’s net income was €35 million, after deducting tax at the effective rate of 39%. In 2018, the effective rate was 0% due to the tax treatment of unrealized gains and losses on mutual funds

At 185%, the subsidiary’s solvency coverage ratio at December 31, 2019 was within the optimal range of [180%-220%] established by the Risk Appetite Framework.

|

€m |

2018R |

2019R |

|

|

|

|

|

Gross written premiums |

464 |

562 |

|

Year-on-year change (%) |

+17% |

+21% |

|

Cost ratio |

5,9% |

5,5% |

|

Life technical margin |

6,9% |

5,2% |

|

Net combined ratio |

99,4% |

98,1% |

|

Return on investment |

2,4% |

2,7% |

|

Current income before equalization reserve |

46 |

56 |

|

Net income for the year |

35 |

35 |

|

|

|

|

|

Solvency coverage ratio (Solvency II) |

189% |

185% |

Financial information

The financial statements were approved for publication by the CCR Group's Board of Directors on April 29, 2020. The CCR Group’s statutory auditors have completed their audit of the financial statements.

Download CCR Group & CCR Re's financial information

Media contact

Sophie Bodin - DGM Conseil

+ 33 (0)1 40 70 11 89

Receive financial information from CCR Re

Receive financial information from CCR Re