CCR Re’s financial statements were approved for publication by the company’s Board of Directors on March 25, 2021.

In an exceptional environment shaped by the Covid-19 pandemic and the Beirut explosion, CCR Re preserved its margins, reporting net income for the year of €18 million.

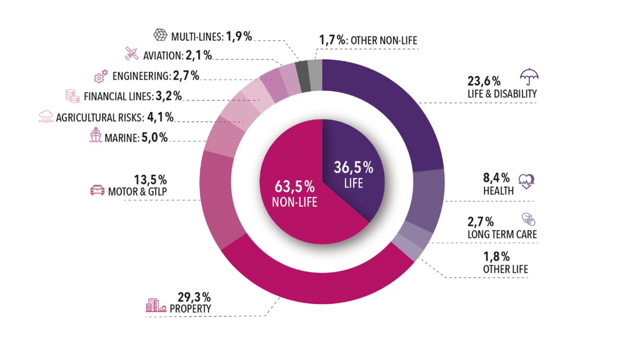

The company’s gross written premium rose 16% to €649 million, in line with the trajectory set in the Streamline strategic plan. The business mix was as follows:

Business Mix

Gross Written Premiums +16%

(Millions of €)

CCR Re’s combined ratio stood at 103.2%. Life technical margin was 2.2%. Excluding the managed impact of the Covid-19 pandemic (€49 million before and after reinsurance) and the Beirut explosion (€24 million before reinsurance and €15 million after reinsurance), underwriting margins continued to improve thanks to pricing action.

CCR Re's return on investment was 2.6%. The portfolio had a market value of €2.9 billion at December 31, 2020, up by some €400 million (+16%) compared to the previous year-end. This increase resulted in particular from the investment of the proceeds of CCR Re’s €300 million Tier 2 subordinated notes issue in July 2020.

Cost ratio improved to 4.9%, in line with the trajectory set in the Streamline strategic plan.

EBITER came to €39 million.

CCR Re’s net income for the year was €18 million.

Solvency coverage ratio (Solvency II)

(Millions of €)

Its solvency ratio stood at 199.2% at December 31, 2020, in the optimal [180%-220%] range defined by the risk appetite framework.

Comparative tables 2019-2020

|

€m |

2019R |

2020R |

|

|

|

|

|

Gross written premium |

562 |

649 |

|

Year-on-year change (%) |

+21% |

+16% |

|

Cost ratio |

5,5% |

4,9% |

|

Life technical margin |

5,2% |

2,2% |

|

Net combined ratio |

98,1% |

103,2% |

|

Return on investment |

2,7% |

2,6% |

|

EBITER |

60 |

39 |

|

Net income for the year |

35 |

18 |

|

|

|

|

|

Solvency coverage ratio (Solvency II) |

185% |

199% |

Financial information

CCR and CCR Re’s financial reports will be published on the companies’ websites on April 14.

Download CCR Group & CCR Re's financial information

Media contact

Sophie Bodin - DGM Conseil

+ 33 (0)1 40 70 11 89

Receive financial information from CCR Re

Receive financial information from CCR Re