CCR Re’s 2021 financial statements were approved for publication by the company’s Board of Directors.

CCR Re was unaffected by the current health restrictions and continued to serve its international clients. The profitability of the company's activity is maintained with a net result of €41 million.

CCR Re posted total premium income of €843m, up 30% year-on-year.

Net of currency effects and prior-years adjustments, growth came out at 21%, in line with the momentum of previous fiscal years.

Highlights

- From an accounting perspective, the provisions reported in 2020 to cover Covid claims were favorably settled, offsetting the cost of the pandemic for 2021.

- Sidecar 157 Re, which was expanded with a third compartment, whose capacity increased significantly.

- S&P and AM Best confirmed CCR Re's financial strength rating as “A Excellent” with a stable outlook.

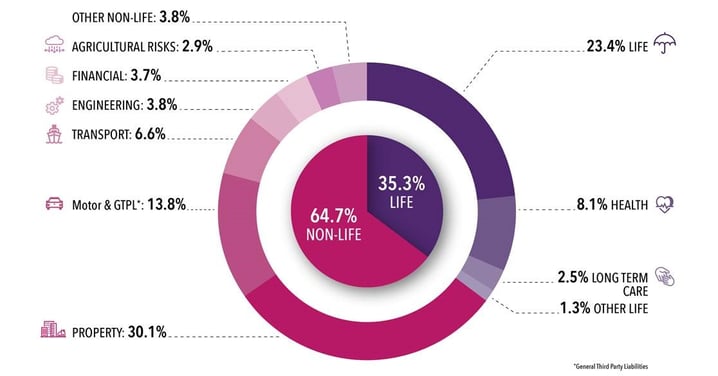

The business mix was as follows:

Business Mix

Gross Written Premiums +30%

(Millions of €)

- CCR Re’s combined ratio stood at 96.6%, representing a significant decrease versus 2020. Against a background of high natural disaster claims, particularly in Germany and Belgium, CCR Re benefited from the protection provided by the retrocession programme (reducing the cost of natural disasters from €79m gross to €43m, net of retrocession).

- In Life, profitability improved with a technical margin of 3.1% while remaining impacted by the cost of Covid-related claims.

- CCR Re’s return on invested assets was 1.9%. As of December 31, 2021, the portfolio had a market value of €3.0bn (an increase of €100m compared to the previous year-end), which included €431m in unrealized capital gains.

- The cost ratio continued its decline to 4.3%.

- EBITER (Earnings Before Interests, Taxes and Equalization Reserve) amounted to €62m.

- All told, CCR Re’s net income for the year was €41m, up considerably on the €18m posted in 2020.

- At its meeting on March 16, 2022, CCR Re’s Board of Directors recommended a dividend payout to shareholders of €12.3m.

- At end-2021, CCR Re’s solvency ratio stood at 192%, in the optimal [180%-220%] range defined by the risk appetite framework.

The occurrence of the war in Ukraine, after the close of the fiscal year, is not expected to adversely affect CCR Re.

CCR Re's reinsurance portfolio is not directly exposed to Ukraine or Russia. The indirect exposure of its Specialty lines is likely to remain limited.

CCR Re’s asset portfolio has no direct exposure and does not hold any assets denominated in rubles or hryvnia. The portfolio is resilient to the market upheaval caused by this event.

Solvency coverage ratio (Solvency II)

(Millions of €)

At end-2021, CCR Re’s solvency ratio stood at 192%, in the optimal [180%-220%] range defined by the risk appetite framework.

Comparative tables 2019-2020

|

€m |

2020R |

2021R |

|

|

|

|

|

Gross written premium |

649 |

843 |

|

Year-on-year change (%) |

+16% |

+30% |

|

Cost ratio |

4,9% |

4,3% |

|

Life technical margin |

2,2% |

3,1% |

|

Net combined ratio |

103,2% |

96,6% |

|

Return on investment |

2,5% |

1,9% |

|

EBITER |

39 |

62 |

|

Net income for the year |

18 |

41 |

|

|

|

|

|

Solvency coverage ratio (Solvency II) |

199% |

192% |

Chairman and Chief Executive Officer of CCR Re, Bertrand Labilloy, commented:

“In its market reinsurance activities, CCR Re delivered an excellent performance, forging ahead in the rollout of its Streamline 2020-2022 strategic plan. As such, CCR Re can look to the future with confidence.”

Financial information

CCR and CCR Re’s financial reports will be published on the companies’ websites on April 14.

See the full CCR Group Press Release.

Media contact

Agathe Le Bars – Taddeo

+ 33 (0)6 73 12 28 24 – agathe.lebars@taddeo.fr

Receive financial information from CCR Re

Receive financial information from CCR Re