CCR Re continued its sound development and produced robust results in a turbulent market.

On 29 March 2023, the Board of Directors of CCR approved the Group’s 2022 financial statements.

On this occasion, Bertrand Labilloy, Chairman & CEO of CCR Re, commented: “In 2022, the targets of the development plan were once again achieved. This strong dynamic justifies the contemplated €200m capital increase that would be subscribed by SMABTP and MACSF and would enable CCR Re to take advantage of the current buoyant market.”

Highlights:

- CCR Re continued to pursue the profitable growth trajectory defined by the board of directors, in a market hit by a combination of major shocks.

- CCR Re does not have direct exposure to Ukraine nor Russia, neither in its reinsurance portfolio, nor in its asset portfolio, and therefore the direct consequences of the war in Ukraine were limited.

- The inflationary backdrop was taken into account, the excess inflation on the cost of claims being assessed prudently, leading to an impact of +564 bp on the Non-Life combined ratio and of -123 bp on the Life technical margin.

Results:

- Total premium income amounted to €987m in 2022, up 17% compared with 2021 (at constant and current exchange rates).

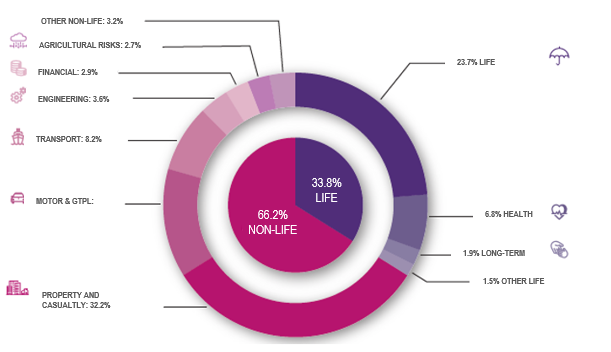

- The business mix was as follows:

− The combined ratio came to 98.7% (96.6% in 2021). The costs related to natural disasters (gross €62m and €35m net of retrocession) was lower than in 2021 (gross €79m and €43m net), offset by the increase in man-made claims. In Life, the profitability of the portfolio improved despite the consequences of inflation, with a technical margin of 3.6%.

− The yield on CCR Re’s investment assets came to 2.3%. The assets of CCR Re stood at €3.0 billion at market value, stable compared with 2021, including €207m in unrealized capital gains (down €224m compared with December 31, 2021).

− The cost ratio of CCR Re stood at 4.1%, down compared with 2021.

− EBITER amounted to €64m.

− CCR Re’s net income for the year was €42m, stable compared with 2021 (€41m).

− CCR Re’s solvency ratio stood at December 31, 2022 was 205%, in the optimal [180%-220%] range defined by the risk appetite framework.

The Board of Directors of CCR Re, meeting on March 15, 2023, decided to propose to the General Meeting of Shareholders the payment of a dividend of €16.8m, in line with the Streamline 2020-2023 business plan.

|

€M |

2021 |

2022 |

|

|

|

|

|

Gross written premium |

843 |

987 |

|

Year-on-year change (%) |

+30% |

+17% |

|

Cost ratio |

4.3% |

4.1% |

|

Life technical margin |

3.1% |

3.6% |

|

Net combined ratio |

96.6% |

98.7% |

|

Return on investment |

1.9% |

2.3% |

|

EBITER |

62 |

64 |

|

Net income |

41 |

42 |

|

|

|

|

|

Solvency coverage ratio (Solvency II) |

192% |

205% |

Cost ratio: Ratio of management expenses net of investment expenses and net of taxes on the one hand, and written premiums gross of retrocession on the other.

Life technical margin: ratio, for Life business, of the sum of technical result and interest on cash deposits on the one hand, and the total earned premiums net of retrocession on the other.

Net combined ratio (CCR Re): for Non-Life business, ratio between the net claims expense excluding variation in the equalization reserve and expenses incurred net of investment expense (including commissions) on the one hand, and net earned premiums on the other.

Net combined ratio (CCR): ratio between the net claims expense including variation in the equalization reserve and expenses incurred net of investment expense (including commissions) on the one hand, and net earned premiums on the other.

Constant exchange rates: changes at constant exchange rates are obtained by comparing 2022 data converted at the exchange rate of December 31, 2021 with 2021 data at the exchange rate of December 31, 2021.

Return on investment: ratio between net investment income on the one hand, and outstanding investments at cost price on the other hand, excluding cash deposits, real estate for own use, and subsidiaries.

EBITER: Earnings Before Interests, Taxes and Equalization Reserve. EBITER. Also excludes non-recurring items.

NB:

This press release contains both historical information and forward-looking statements with respect to CCR and CCR Re. Forward-looking statements contain information about future events, expectations, objectives and performance, and are based on assumptions currently adopted by CCR and CCR Re management. Although CCR and CCR Re believe that these forward looking statements are based on reasonable assumptions, they are not a guarantee of the future performance of CCR or CCR Re. Actual results may differ materially from the forward-looking statements as a result of risks and uncertainties. CCR and CCR Re undertake no obligation to publish updates or revisions of these forward-looking statements.

This 2022 annual results press release and the presentation can be accessed from the www.ccr.fr and www.ccr-re.com websites.

See the full CCR Group Press Release.

Media contact

Vincent Gros – General Counsel + 33 (0)1 44 35 38 36 - vgros@ccr.fr

Agathe Le Bars – Taddeo + 33 (0)6 73 12 28 24 – agathe.lebars@taddeo.fr

Receive financial information from CCR Re

Receive financial information from CCR Re