Mathieu Halm, Head of Retrocession and Strategy at CCR Re, shares his thoughts on various topics about Insurance Linked Securities (ILS), which he selects quarterly. The securitization of insurance and reinsurance risks is, indeed, an unknown but exciting topic in this industry.

Covid-19 tests ILS and already shows some challenges

Coronavirus represents a new opportunity, following the 2008 financial crisis, to demonstrate that ILS are not an ephemeral asset class, doomed to disappear at the first sign of trouble, but rather an alternative offering interesting diversification for investors. It is still too early stages to draw initial conclusions from the current events we are currently going through. Investor reaction is therefore being carefully scrutinized. It should be noted, however, that this asset class remains very modest and, more often, does not top the list of fund managers’ concerns.

Another aspect of the current crisis, according to Trading Risk magazine, the Pandemic bond sponsored by the World Bank will finally be triggered and allow developing countries to benefit from $133M to help them fight the Covid-19 pandemic. Criticized for not having been triggered earlier to provide financial assistance to fight the virus from spreading, the World Bank must now communicate on the beneficiaries of this coverage (country and/or NGOs).

To conclude on the challenges related to Covid-19, you may refer to the excellent article written by Steve Evans on the challenge facing American mortgage insurers whose ILS issues are proving to be an increasingly important part of their capital management. The cost of their traditional reinsurance should indeed be impacted by the Coronavirus and subsequently increase over the next renewals, while access to the financial markets via ILS is likely to be complex.

Innovations and development of new markets

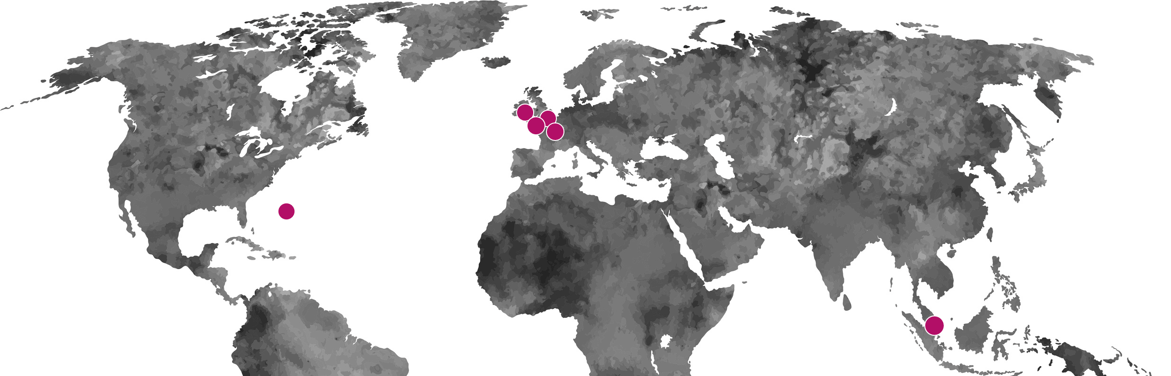

Furthermore, it is interesting to note that during the last two or three years, the ILS market has seen a number of initiatives allowing the emergence of new markets such as London, Singapore or even Paris, but also the implementation of innovations in particularly active jurisdictions like Bermuda and Guernesey.

Whereas Singapore, is trying to stand out by offering assistance from the Monetary Authority of Singapore (MAS) to finance associated costs pertaining to the issuance of a transaction, up to a maximum of $2M. As a matter of fact, the Singaporean regulator has clearly understood that to foster the emergence of an ecosystem, it is necessary to help the development of various service providers within the city-state and needed for the issuance and monitoring of ILS transactions. Of course, Singapore’s attractiveness does not solely rest on this financial support and relies, among other things, on a process for obtaining regulatory approval within four weeks on average or even two weeks via a “fast-track” process.

The Paris financial centre

It is therefore interesting to consider how the Paris financial centre can succeed, as a first step, in appearing in the ILS domiciliation landscape and, secondly, in establishing itself there on a permanent basis. It cannot claim to shake up hierarchy but can probably gradually establish itself alongside Bermuda, Dublin, London, Singapore and other financial centres by relying on a regulator recognized for its excellence and issues that are compatible with Solvency 2 regulations. Furthermore, it can steer its development by promoting the ESG-compatible aspect of emissions and this theme is fully in line with the underlying objectives of such emissions.

Nevertheless, as clearly understood by Singapore, it is essential to foster the emergence of an ecosystem. Paris is fortunate enough, on its financial scene, to be able to secure insurers and reinsurers such as Scor, Axa XL, Covea, CCR Re and other potential issuers. It can also rely on investors (Axa IM, Scor Investment …).

There are also law firms, asset management companies, custodian banks but also brokers competent in this field. Under these conditions, it may become necessary to create incentive tools to encourage the emergence of this ecosystem, and promote Paris as a financial centre.